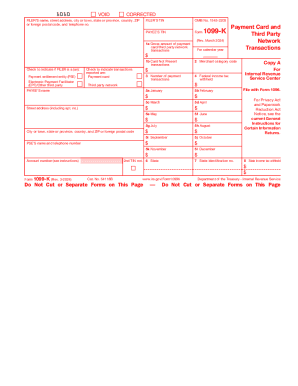

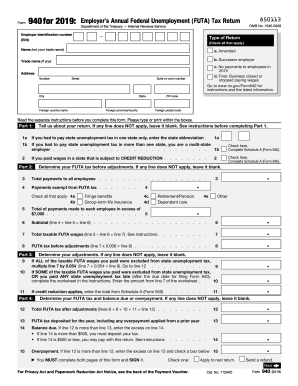

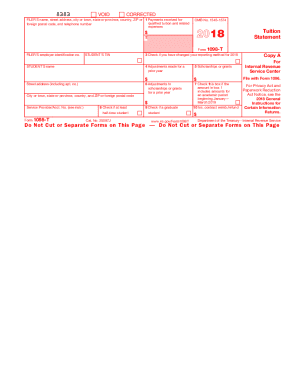

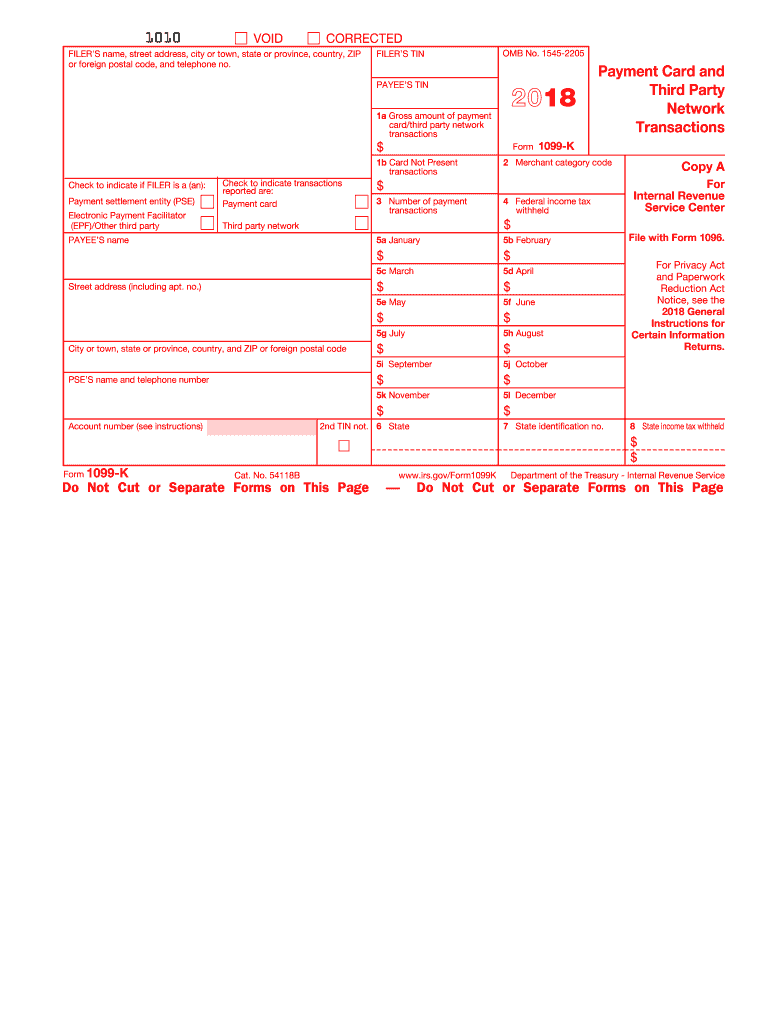

IRS 1099-K 2018 free printable template

Instructions and Help about IRS 1099-K

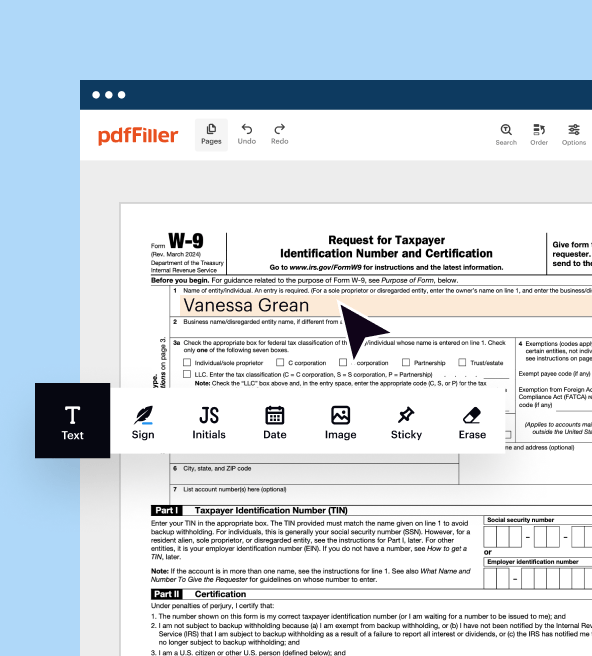

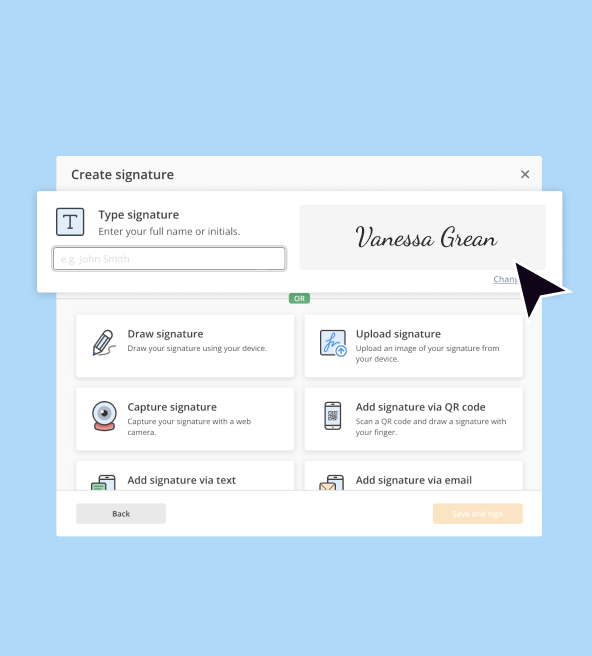

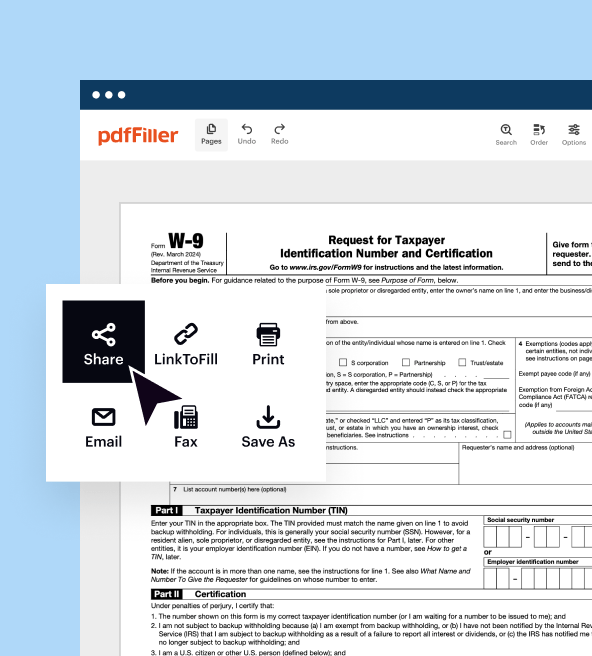

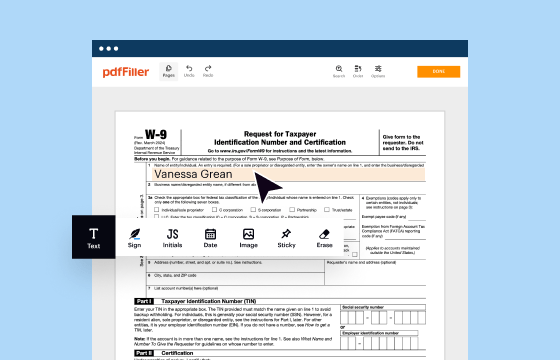

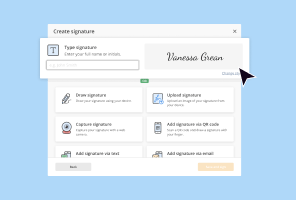

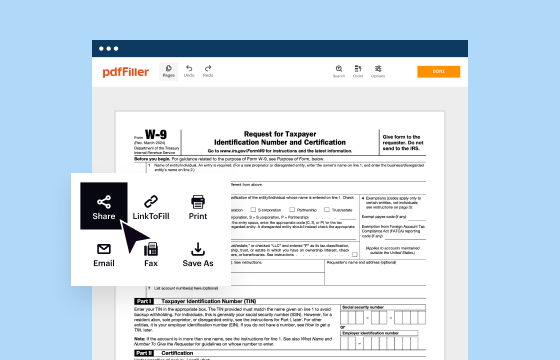

How to edit IRS 1099-K

How to fill out IRS 1099-K

About IRS 1099-K 2018 previous version

What is IRS 1099-K?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

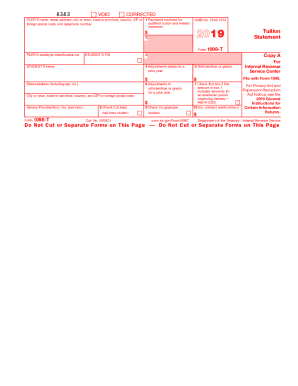

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-K

What should I do if I realize I made an error on my IRS 1099-K after filing?

If you've made an error on your IRS 1099-K, you should file an amended return. This process involves submitting a corrected form with accurate information, ensuring it reflects any changes. It's important to include a statement explaining the errors and any corresponding documentation to avoid issues with the IRS.

How can I track the status of my submitted IRS 1099-K?

To track the status of your IRS 1099-K submission, you can check IRS tools online specific for e-filed forms. Be aware of common e-file rejection codes, as these can guide you on any issues that might prevent your form from being processed. Regularly monitoring your submission ensures that you address potential problems promptly.

Can I file IRS 1099-K electronically, and are there specific requirements for this?

Yes, you can file IRS 1099-K electronically, which is often quicker. Ensure your software is compatible with IRS standards and check for any specific technical requirements. Some e-filing services may charge fees, but submitting electronically may speed up processing times and enhance accuracy.

What should I do if I receive a notice from the IRS regarding my filed 1099-K?

If you receive a notice from the IRS about your filed 1099-K, review the notice carefully to understand the issue. Typically, you'll need to gather relevant documentation that supports your filing and may need to respond promptly to resolve any discrepancies or provide additional information.

See what our users say